Beyond interaction: 4 reasons banks should use social media

13 April 2013

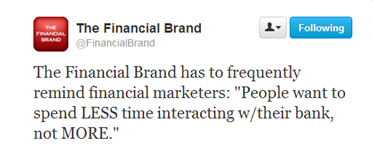

An interesting tweet from The Financial Brand got me thinking last week: if people want to interact with their bank less, why are we trying to encourage financial services to be more active on social media – a platform which by nature tries to encouragemore interaction?

What people often forget, however, is that there’s more to social media than interacting with customers. Here are a few reasons why social media shouldbe used by financial institutions:

1. Social media a great tool for listening. Companies sometimes forget that social media is just as much about listening to your customers, prospects, and even competitors, as it is about engaging. By listening to what is being said on social media, companies are able to deliver the products and services customers want, and allows them to gauge market trends. It also allows a company to identify when something negative is being said about them; and enables them to respond before the issue escalates.

2. Social media can provide valuable data. From social media, an organisation can learn a lot about its customers; from wants and needs, to location, to death of a cat…you name it. On social media people divulge a lot of personal information, and it’s quite often kept up to date. For banks, this adds to the extensive amount of data already held about their customers; increasing the ability to deliver personalised and relevant services.

3. It’s a great customer service channel. (Yes, ok, this could technically be classed as “interacting”)…Nowadays customers are more mobile and busier than ever before. They want to be able to raise queries quickly and easily, wherever they are. People no longer want to be on hold for half an hour before a customer service representative can speak to them. Through social media, customers are able to quickly raise queries, and companies are able to deal with complaints quickly and effectively. Although some customers may be wary of using social media as a customer service channel with their bank due to the sensitive information such interactions involve, some financial service brands (such as Citi) already have this nailed – customers raise a query on Twitter, Citi sends a Direct Message to that customer, and the issue is then taken offline via telephone.

4. It’s how Generation Y want to engage. Like it or not, those rowdy twenty-somethings are your future customers, and they love social media. Gen-Y (individuals born after 1980) are associated with technology and prefer to use digital channels. Being where your customers are is an important element of business success; Gen-Y customers are on social media, so banks should be as well.

I’m not telling you that interacting with customers and prospects on social media isn’t important – it is; you're not being social otherwise. What I’m trying to get across is the importance of being on social media, even if it’s not your customers’ channel of choice.