Going for gold in finance content marketing

30 July 2013

“Content is king” is probably one of the most overused pieces of marketing jargon today, and it technically isn't true. In reality, content is just "stuff" - news, blogs, images, etc. without much meaning. What makes content "king" is quality. Engaging the audience. Giving the customer something valuable, which actually has meaning.

Creating quality content has become instrumental for successful marketing, thanks to the internet. Prospective customers are now able to conduct full, in depth research into a brand and its competitors before making a purchase decision. And it's valuable, insightful content which helps influence this decision.

The good news is that the majority of marketers recognise the importance of content marketing; 97% of B2C and 95% of B2B marketers are adopting content marketing, according to the CMI.

But where does content marketing fit within financial services? A recent Twitter chat conducted by the CMI revealed some interesting insights from industry professionals.

The challenges

Unsurprisingly, when asked about the challenges financial services face with content marketing, regulation was cited by many. Indeed, when I worked as a financial services marketer I experienced this first hand. Every piece of content which would reach the public domain had to be approved by a number of compliance teams. Approval could take weeks; months, if there were changes to be made. And when you consider that each market has slightly different compliance rules, you meet further obstacles. Content must be tailored to meet the regulatory policies in each market, but at the same time, must not be so diverse that a disjointed message is delivered to the audience.

Another challenge identified was consumer trust – or, lack of it. If your customers don’t trust your brand, how are they going to trust your content? With trust of financial services at an all-time low, it’s no wonder this is a struggle. So how do you build that trust? You could get on social media and start building relationships with your customer for a start.

The opportunities

The financial services industry has access to a vast amount of data about customers, from buying habits, to the channels they use (mobile, online...), and more. This data can be used to make great content such as whitepapers and infographics, or for creating more targeted marketing campaigns. It’s generally argued that financial services don’t do enough with the data they hold, so start looking at this data, analysing it and creating insightful content which can help shape the future of financial services, and possibly other industries such as retial.

Where does social media fit?

Social media plays a big role in amplifying the content you create, and the better the content you create, the higher the reach as people decide to share your content.

Post your content assets on your own social media channels, and on the content itself include social sharing links and details fo your social media presence. Poeple may want to start discussions around your content, so give them the ability and the platform to do this. And, ensure that you are part of this conversation.

Are any financial services organisations doing well with content marketing?

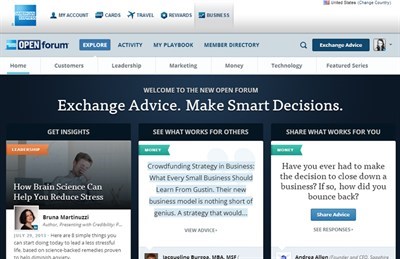

Participants on the CMI's Twitter chat were able to reel off a string of examples of what they felt was good content marketing by financial services firms. But the example which sticks in the forefront of my mind is AmEx's Open Forum; a business network connecting small business owners. There are a few reasons why Open Forum is a fine example of content marketing:

- It is essentially a community of small business owners, networking and sharing advice

- There's a great social element behind it

- Much of the content isn't created by AmEx itself; instead, it's from major sites and publications, with some content also created by the network's members themselves, giving a host of user generated content and demonstrating a high level engagement within the community

- The community is specifically targeted towards one of AmEx's key customer segments (small businesses), and the AmEx branding over the website makes it unmistakable as to which company is the brains behind the network

While regulations challenge financial services institutions, these should not restrict the ability to create high quality content. Financial regulations have been around for years, and apply to all marketing activities regardless of whether they’re online or offline, so financial marketers should already possess the knowledge and skills to overcome these challenges to create meaningful content.