Fintech B2B marketer’s guide for 2024 planning: How to engage banking technology decision makers

06 November 2023

With planning for 2024 now in full swing for fintech B2B marketers, we want to help put some data behind your decisions by sharing key insights from Metia’s market report, ‘The State of the B2B Financial Technology Buy-cycle’.

Among the many insights delivered, the report reveals what really motivates business decision makers (BDMs) to introduce new solutions and partners, their top purchase drivers, the channels they frequent and the content they consume. Better understanding these drivers and the unique traits of your audience is the secret to effectively engaging BDMs in banks. It’ll be more successful than simply shouting the virtues of your solution at them.

Cut through the noise in 2024

The fintech ecosystem is saturated with vendors and fintechs. Each tech vendor makes the case that their offer shines above all others, delivering value for money, long-term ROI and essential functionality. Fintechs are no longer bootstrapping startups either. A large number are now well-established, have significant revenues and large marketing budgets, and have pivoted to sell to banks, not compete with them.

This saturation and budget spend leads to considerable noise in the marketplace as vendors and fintechs compete for share of voice. But it turns out that less is often more when it comes to capturing the hearts and minds of BDMs in banks.

Resonate with the audience

In short, it’s much more important to say the right thing than simply to say a lot. Clarity of positioning, with consistent and resonant messaging will cut through noise and touch the motivations and triggers of the audience.

In the case of BDMs, it’s also important where you say it, as they prefer specific channels, content and media. The report reveals where to find them and how to engage them.

With banks almost twice as likely to have more than six vendors bidding for any major technology purchase than their counterparts in other industries, going beyond the technology and aligning to their own business priorities on a deeper level is essential.

Bank BDM motivations for 2024

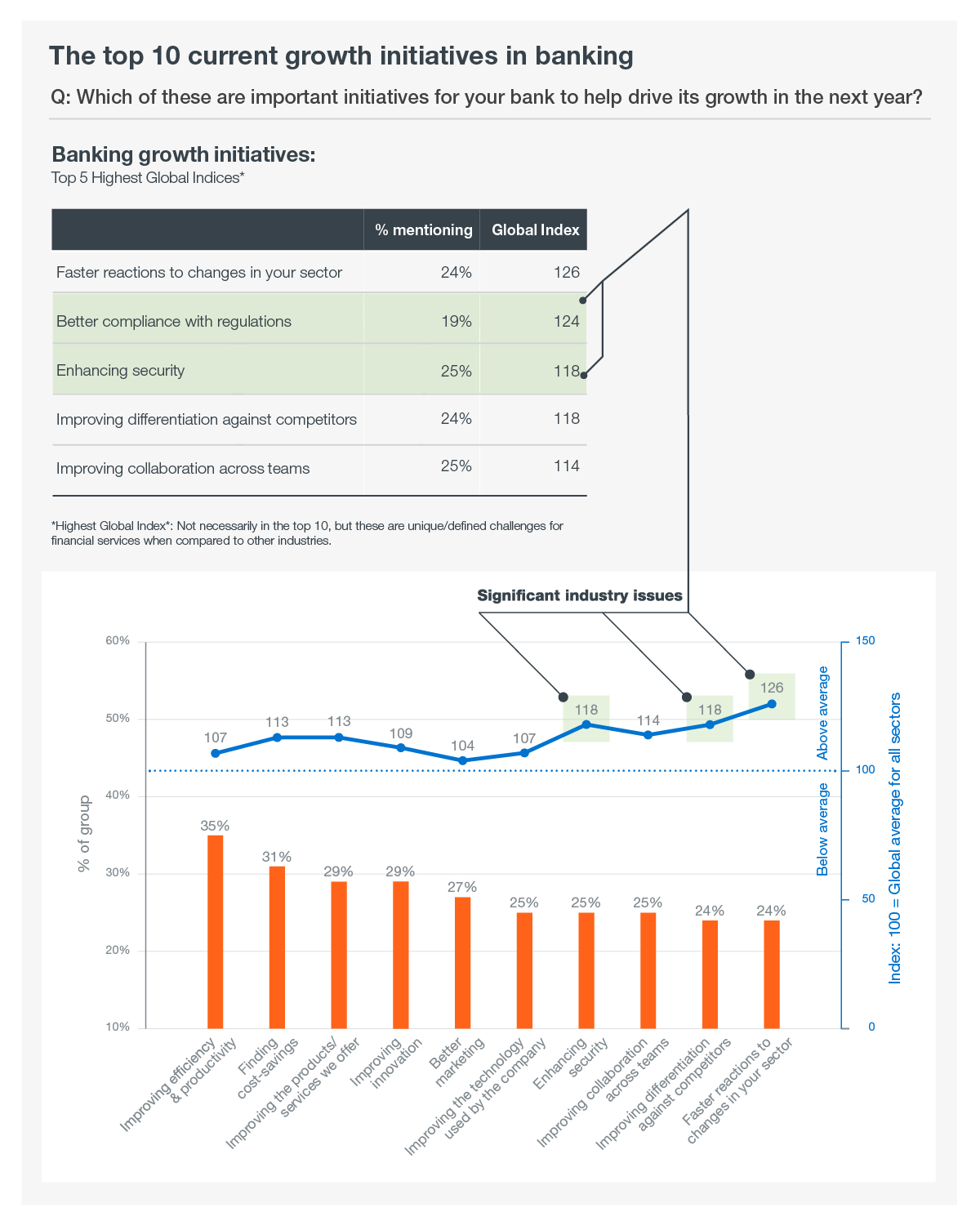

Our research identified the top three initiatives BDMs planned to implement are focused on:

- Ensuring their organisation is agile enough to react at pace to industry changes.

- Improving differentiation against competitors.

- Enhancing security.

Other pain points highlighted reveal the need for BDMs to align with their organisations’ growth initiatives, such as improving products and services, internal technology, and ensuring better compliance with regulations. Making sure new technology also integrates with existing solutions is one of the most significant purchase drivers for BDMs, revealing the complexity of the challenges they must navigate—and the information they need when it comes to selecting a partner or solution.

Vendors and fintechs that can clearly show how their solutions deliver against each of these areas, and communicate this within the channels bank BDMs frequent, will stand a better chance of starting new business conversations in 2024.

It’s no surprise that banks worry that they are not keeping up with industry change and their more innovative peers, especially when the challenge is compounded by legacy technology infrastructure. In fact, BDMs in banks are 1.7 times more likely than their peers in other industries to be looking for new technology partners, precisely because their current technology is failing them.

The urgency of the situation is, in part, revealed by the fact that the cost of technology is less of a concern for banks than organisations in other sectors.

Informing your 2024 marketing plans

These are just a snapshot of the insights that will share over the coming weeks to help you close the gap and provide bank BDMs with the right messages at key inflection points across their technology purchasing journeys.

You can download the full report here, or follow this series of posts, in which we will summarise key insights. Alternatively, get in touch and we can talk you through the best takeaways.

In the next post, I’ll dive deeper into the top buying cycle triggers for senior banking decision makers and find out what really motivates them to bring in new technology partners and solutions.